Life is full of uncertainties. One of the most responsible and important financial decisions you can make is to ensure your loved ones are protected in case something unexpected happens to you. Life insurance is a tool designed to provide financial security for your family by paying out a sum of money—known as a death benefit—to your beneficiaries after your death.

Among the various types of life insurance available, term life insurance is one of the simplest and most affordable options. But what exactly is term life insurance, and how does it work? This article will provide a complete guide to understanding term life insurance, exploring its features, benefits, types, cost factors, and more. Whether you are considering buying life insurance for the first time or want to understand the differences between term and permanent life insurance, this article will help you make informed decisions to protect your family’s future.

Key Takeaways

- Term life insurance offers coverage for a set number of years.

- It pays a death benefit if the insured dies during the term.

- It is more affordable than permanent life insurance.

- It does not build cash value.

- Choose a coverage amount and term based on your financial needs.

- Many policies offer renewability and conversion options.

- Review and manage your policy regularly to ensure continued protection.

What Is Life Insurance?

Before diving into term life insurance, it’s important to understand what life insurance is in a broader context.

Life insurance is a contract between you (the insured) and an insurance company. You pay regular premiums, and in exchange, the insurance company promises to pay your beneficiaries a death benefit if you pass away during the term of the policy. The purpose is to provide financial protection for your dependents and cover expenses such as funeral costs, debts, mortgage payments, education costs, and general living expenses.

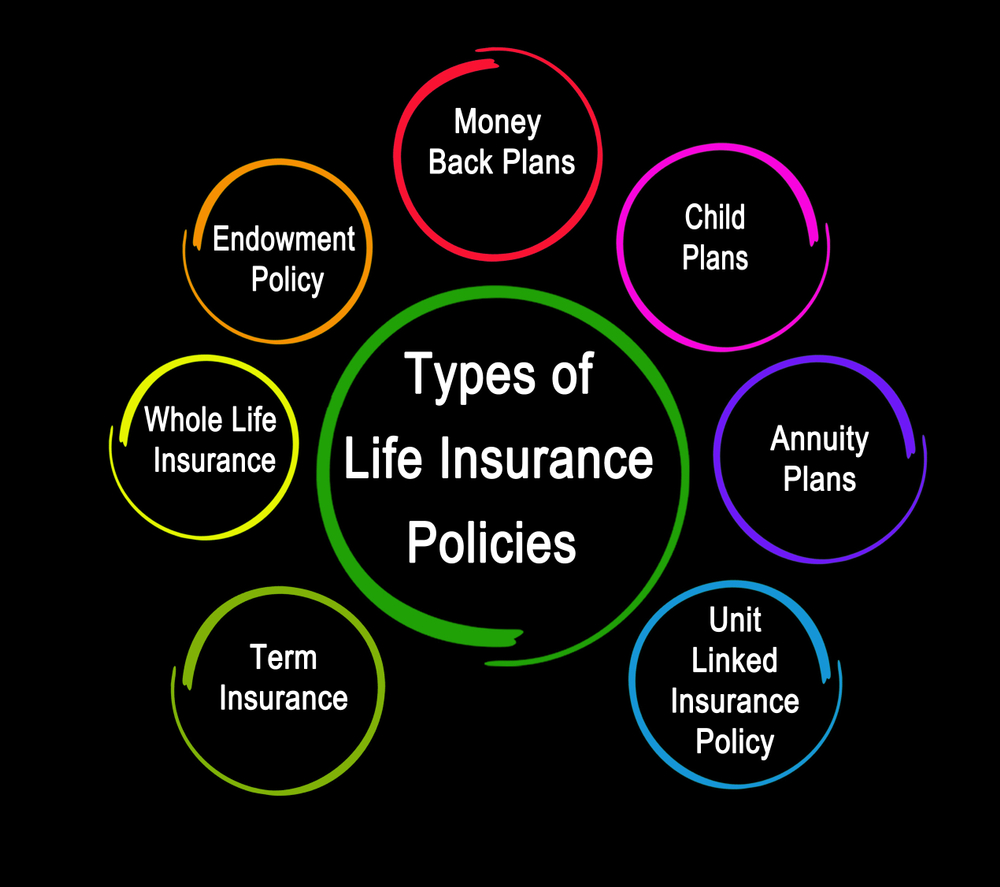

Life insurance is broadly divided into two categories:

- Term Life Insurance: Provides coverage for a fixed period.

- Permanent Life Insurance: Provides lifelong coverage and often has a cash value component.

This article focuses primarily on term life insurance — an accessible, straightforward option for many people.

What Is Term Life Insurance?

Term life insurance is a type of life insurance that offers coverage for a specific period or “term” — commonly 10, 15, 20, or 30 years. During this time, if the insured person dies, the insurance company pays a death benefit to the named beneficiaries. If the insured person survives the term, the policy expires with no payout.

Term life insurance is sometimes called “pure insurance” because it provides only a death benefit without any savings or investment features. It’s designed to offer affordable, temporary financial protection for families during critical periods, such as while raising children or paying off a mortgage.

Key Features of Term Life Insurance:

- Fixed term length: Choose the length of coverage, usually between 5 to 30 years.

- Death benefit: The fixed amount paid to beneficiaries if the insured dies during the term.

- No cash value: Unlike permanent policies, term policies don’t accumulate savings or cash value.

- Affordable premiums: Because it doesn’t build cash value, term insurance is usually less expensive than permanent insurance.

- Renewability and convertibility: Some policies allow you to renew or convert to permanent insurance without a medical exam.

How Does Term Life Insurance Work?

| Step | Description |

|---|---|

| Choose Coverage Amount and Term Length | Decide how much coverage you need (death benefit) and for how many years (term) based on financial needs. |

| Apply for the Policy | Submit an application with personal, health, and lifestyle details; may include a medical exam. |

| Pay Premiums | Make regular premium payments (monthly or annually) to keep the policy active. Premiums are usually fixed during the term. |

| Coverage Period | Insurance coverage is in effect for the selected term. If the insured dies during this time, the policy pays the death benefit. |

| Death Benefit Payment | If the insured passes away during the term, the insurance company pays the death benefit to the named beneficiaries, typically income tax-free. |

| End of Term | If the insured survives the term, the policy expires with no payout. Some policies allow renewal or conversion to permanent insurance. |

Understanding how term life insurance works can help you decide if it’s right for you. Here is a step-by-step look at the process:

Selecting Your Coverage Amount and Term Length

You begin by determining how much coverage you need. The death benefit amount should reflect your financial obligations, such as income replacement, debts, mortgage payments, education costs, and other expenses you want covered for your dependents.

Next, you choose the term length—how many years you want the coverage to last. This usually corresponds to your financial planning horizon, for example, the number of years until your children finish college or your mortgage is paid off.

Applying for the Policy

You complete an application form providing personal details like age, health history, lifestyle, and occupation. Some policies require a medical exam, while others offer simplified or no-exam underwriting options.

Paying Premiums

You pay premiums, typically monthly or annually, which remain fixed for the length of the term. The premiums are based on your age, health, term length, and the amount of coverage.

Coverage in Force

Your policy is active, providing coverage for the term you selected. If you die during this period, your beneficiaries file a claim with the insurance company.

Death Benefit Payout

Upon your death during the policy term, the insurance company verifies the claim and pays the death benefit to the beneficiaries tax-free.

End of Term

If you outlive the term, your coverage expires, and there is no payout. Depending on the policy, you may have options to renew, convert, or buy a new policy.

Types of Term Life Insurance

There are different types of term life insurance policies designed to fit different needs:

Level Term Life Insurance

This is the most common type of term life insurance. The death benefit and premiums remain the same throughout the term. For example, if you buy a 20-year level term policy with a $500,000 death benefit, your premiums and coverage stay consistent for the full 20 years.

Decreasing Term Life Insurance

With decreasing term, the death benefit gradually decreases over the policy term, often in line with a declining debt, such as a mortgage. Premiums usually remain level. This policy is typically used to cover specific debts that reduce over time.

Renewable Term Life Insurance

This type allows you to renew the policy at the end of the term without undergoing another medical exam. However, premiums usually increase with age at renewal.

Convertible Term Life Insurance

Convertible policies let you convert your term insurance into permanent insurance without a medical exam, usually at a higher premium. This feature offers flexibility if your insurance needs change.

Benefits of Term Life Insurance

Term life insurance offers several advantages, which explain its popularity:

- Affordability: Because term policies don’t build cash value, they have lower premiums compared to permanent insurance.

- Simplicity: Term insurance is straightforward and easy to understand.

- Financial Security: It provides a large death benefit that can replace lost income and pay expenses.

- Flexibility: You can choose coverage duration tailored to your specific needs.

- Temporary Coverage: Perfect for covering debts and financial responsibilities with a finite time frame.

- Convertible Options: Some policies let you convert to permanent insurance, adding flexibility.

Who Should Consider Term Life Insurance?

Term life insurance is ideal for individuals who need temporary, affordable financial protection. This includes:

- Young families with dependents.

- Individuals with a mortgage or significant debt.

- People with limited budgets seeking maximum coverage.

- Those wanting coverage during specific financial obligations (child-rearing years, loan repayment).

- Anyone looking to supplement an existing permanent policy.

Factors Affecting Term Life Insurance Premiums

Several factors influence how much you pay for term life insurance:

- Age: Younger applicants pay lower premiums.

- Health: Better health results in lower premiums; smokers and people with medical conditions pay more.

- Term Length: Longer terms generally cost more.

- Coverage Amount: Higher death benefits increase premiums.

- Lifestyle: Risky occupations or hobbies can increase rates.

- Family Medical History: A history of serious illness in your family may affect your premium.

How to Choose the Right Term Life Insurance Policy

Choosing the right policy involves:

- Assessing your needs: Calculate coverage amount based on debts, income replacement, and future expenses.

- Selecting term length: Choose a term that covers your financial obligations.

- Comparing quotes: Get multiple quotes from reputable insurers.

- Understanding policy terms: Check for renewability, convertibility, and riders.

- Checking insurer reputation: Choose a financially stable company.

- Reviewing exclusions: Understand what is not covered.

- Consulting a professional: Financial advisors can provide tailored advice.

Term Life Insurance vs. Whole Life Insurance

Comparing term and whole life insurance is crucial for informed decision-making:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10-30 years) | Lifetime coverage |

| Premiums | Lower, fixed during term | Higher and fixed for life |

| Death Benefit | Paid if death occurs during term | Paid upon death anytime |

| Cash Value | None | Builds cash value over time |

| Purpose | Income replacement/temporary needs | Savings and lifelong protection |

| Cost | More affordable | More expensive |

Common Misconceptions About Term Life Insurance

- “Term life is a waste if you outlive the policy.”

While you don’t get money back if you outlive the term, it provides affordable coverage when you need it most. - “Permanent insurance is always better.”

Permanent insurance is costly and not always necessary. - “Term life insurance is complicated.”

Term insurance is actually simpler than permanent policies. - “Term life policies can’t be converted.”

Many term policies allow conversion to permanent insurance. - “Only older people need life insurance.”

Young adults with dependents often benefit most from term insurance.

The Application Process for Term Life Insurance

- Initial inquiry and quote: Gather quotes based on your age and coverage needs.

- Application form: Provide personal, health, and lifestyle information.

- Medical exam: Many policies require a medical exam.

- Underwriting: Insurer assesses risk and approves policy.

- Policy issuance: Receive policy documents and start paying premiums.

What Happens When the Term Ends?

If you outlive your term life insurance policy, the coverage expires. Depending on the policy, you may have options to:

- Renew the policy: Usually at higher premiums.

- Convert to permanent insurance: If your policy includes this option.

- Purchase a new policy: But premiums will be based on your current age and health.

Managing Your Term Life Insurance Policy

- Regularly review your coverage to ensure it meets current needs.

- Update beneficiaries after life changes.

- Keep premium payments current to avoid policy lapse.

- Know your renewal and conversion options.

- Communicate with your insurer if your health or lifestyle changes.

Also Read : What Is The Best Car Insurance In 2025?

Conclusion

Term life insurance is an essential financial tool for those seeking affordable and effective protection for a defined period. It provides peace of mind knowing your family will be financially secure if the unexpected happens. With its simplicity, flexibility, and low cost, term life insurance is ideal for young families, homeowners, and individuals with specific financial obligations.

Choosing the right term life insurance involves understanding your coverage needs, comparing policies, and considering renewability or convertibility options. Remember, the best policy is one that fits your unique circumstances and offers the protection your loved ones deserve.

Frequently Asked Questions (FAQs)

1. What happens if I miss a premium payment?

Missing a premium can lead to policy lapse unless there’s a grace period. Always pay premiums on time.

2. Can I convert my term life insurance to a permanent policy?

Many term policies allow conversion to permanent insurance without a medical exam, usually within a specified period.

3. Is the death benefit taxable?

Generally, the death benefit is tax-free to beneficiaries.

4. How much term life insurance do I need?

Calculate your financial obligations, income replacement needs, debts, and future expenses to determine coverage.

5. Can I buy term life insurance if I have a pre-existing condition?

Yes, but premiums may be higher, or you may qualify for limited coverage.

6. What is the difference between level and decreasing term insurance?

Level term keeps the death benefit fixed; decreasing term reduces the benefit over time.

7. Can I renew my term life insurance after the term ends?

Yes, many policies offer renewability but at higher premiums.